Building a portfolio, how to structure it

So your starting you investing journey and want to start you own portfolio. There's a few ways to go about this, and most of it is correlated with how much risk you're willing to take or how risk averse you are.

Categories of investments

This is where you money will be directly invested. There are a few categories of investments, these catergories also have sub categories which affect the main category. The main categories:

Stocks

Stocks are direct investments within a company, this allows you to own part of the company, allowing you to share in their profits, success, share price increases and decreases. Different companies operate in different industries, these industries are the sub-categories.

Commodities

Commodities are usually raw resources that can either be consumed, or can be manufactured into other usefull products, this includes gold, platinum, some produce(farming related goods) etc.

ETFs/Mutual Funds

ETFs and Mutual Funds are somewhat the same with the main difference being ETFs are traded throughout the day allowing for price flucuations througout the day while Mutual Funds are only traded once at the end of the day and their price only changes once at the end of the day. ETFs and Mutual funds are managed by professionals who buy different stocks and Commodities all tracked by one fund, the overall investment in ETFs and Mutual Fund allows you to have a market spread without having to actually invest physically in all the different stocks.

See it as buying a movie ticket, everybody who owns the ticket makes it possible for everyone else to watch the movie without having to carry all the cost of running the cinema. ETFs and Mutual funds invest in different industries and indexes these form part of their sub-categories.

The allocation and structure of your portfolio

Maintaining a "spread"

A good rule to maintain is the 25% rule, this rule states that your portfolio cannot have more than 25% of your total capital in one specific industry, stock, commodity or fund. This is a good strategy to follow in order to manage your risk, it allows you to receive the gains from those "areas" but when they start reducing in value then at least your whole portfolio isn't invested in them.

This is a good backbone to your portfolio, allowing you the safety and risk managment if need be. There are a lot of similar rules to this, where the main change is the percentage 5%, 10%, 15% etc.

Single Category Investments

The name pretty much somes it up, it's not a very complicated term, but you basically only invest in one category like stocks or commodities or ETF/Mutual funds. This is a bit more risky when you are new to Investing and especially if you only invest in Stocks and commodites, since these are basically concentrated investments which will most likely allow for higher volatility. But in cases where you solely buy ETFs/Mutual funds your money isn't concentrated in one specific stock, it gets spread over many stocks and industries, which means the volatility and price fluctuation will most likely be less.

The Build

Three examples of good builds, the first one would be high risk, the second will be medium risk and the last will be low risk. All these funds have the same structure but the make up would be different, first we'll split them up in 25% quarters, these will be our overall backbone, after this we'll allocated different Funds and Stocks as we see fit within those quarters.

For the sake of the build ETFs and Mutual funds are consider the same

High risk

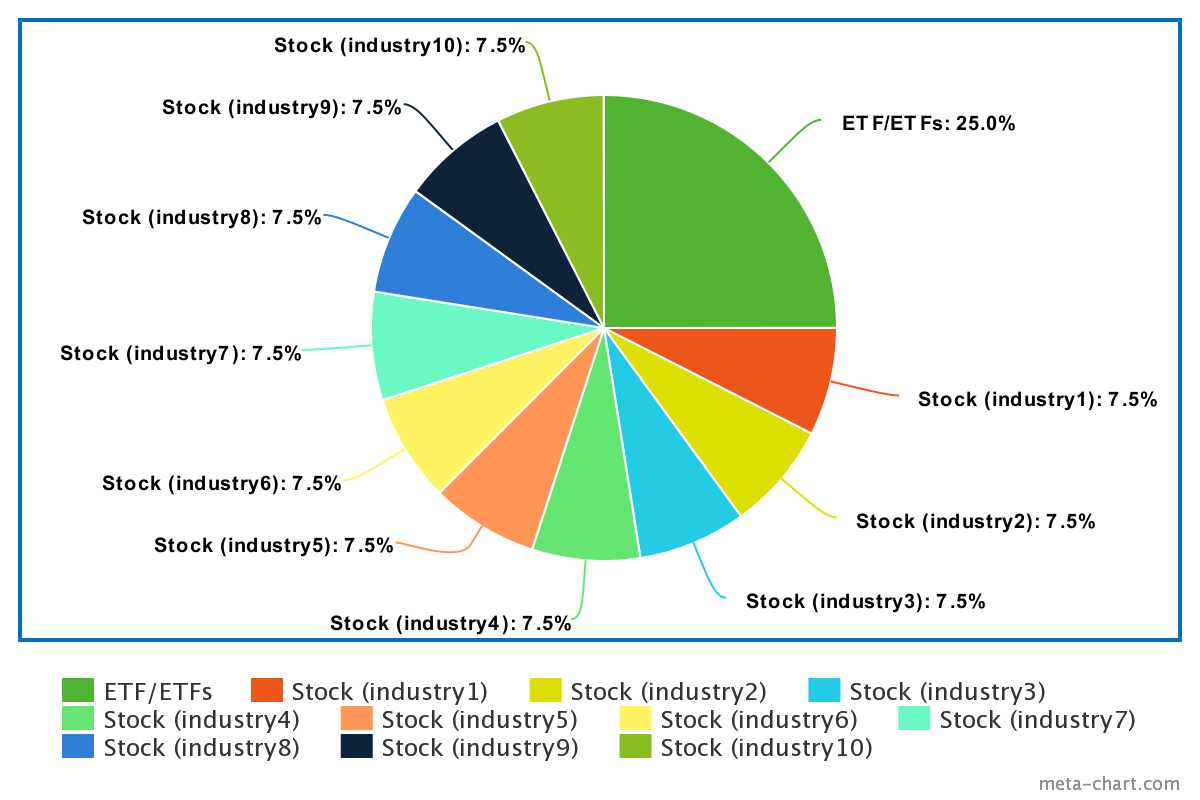

For a high risk portfolio, your allocation will be as follows:

- ETF/ETFs 25%

- Stocks +/- 10 consisting of a cumulative 75%

With this portfolio you'll see that all the stocks are in different industries, this is not necessarily a must, but it helps mitigate risk, and is advised. Once you start out with this type of portfolio, spread your money over a variety of industries, and then if you have underperforming stocks you can sell and buy as you see fit.

Medium risk

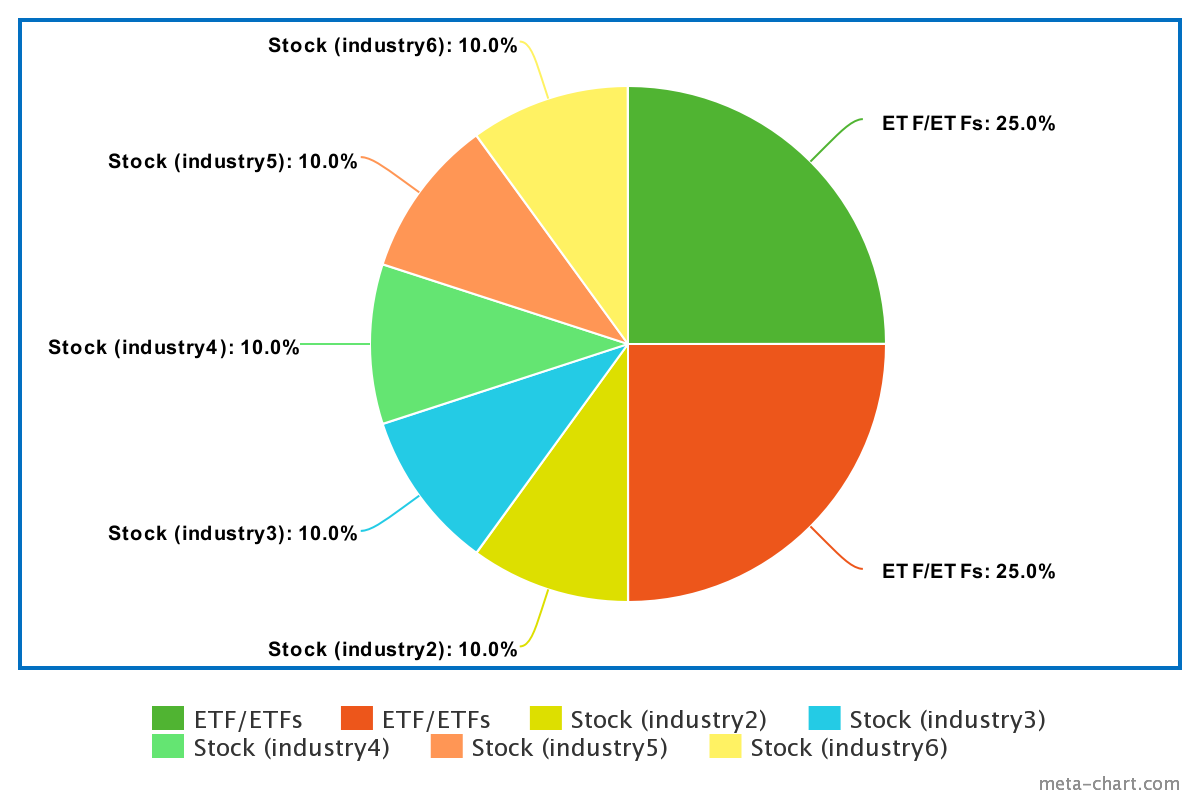

For a medium risk portfolio, your allocation will be as follows:

- ETF/ETFs 50%

- Stocks +/- 5 consisting of a cumulative 50%

With this portfolio, it is best to have ETFs consisting of half of your portfolio. This allows you addequated risk management if you are not confident with your stock picking skills. Half of the portfolio should consists of two or more ETFs tracking different industries/indexes, this allows you to prevent to much of a loss if the ETFs reduce in value.

Low risk

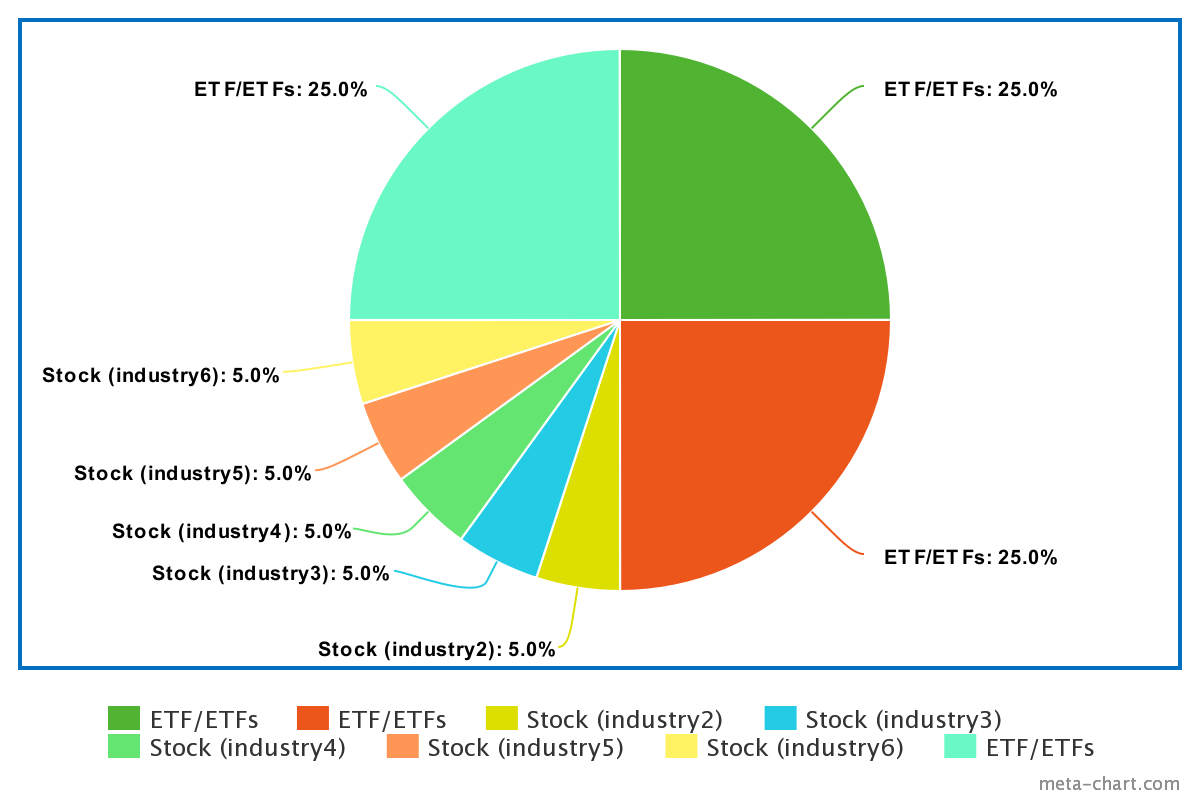

For a low risk portfolio, your allocation will be as follows:

- ETF/ETFs 75%

- Stocks +/- 5 consisting of a cumulative 25%

With this porfolio, the majority of your money(75%) is managed by funds, a minimum of 3 all tracking different industries/indexes, this allows you to opt into professional knowledge, in order to compensate for you lack of knowledge, or if you just want to play is safe. The rest of the porfolio(25%) consists of stocks of which there is a minimum of 5 all in different industries, this allows you to trade some stocks but not be to worried about the changes.