This week ahead || Apr 29th - May 3rd 2024

Here's your news for the week ahead.

A Fed meeting, jobs report, and more Big Tech earnings: What to know this week

Stocks rebounded last week driven by strong tech earnings despite concerns about higher interest rates. The Nasdaq Composite rose over 4%, the S&P 500 almost 3%, and the Dow Jones Industrial Average less than 1%. This week, markets will focus on the Fed meeting, the April jobs report, and earnings from tech giants Apple and Amazon. Fed Chair Jerome Powell is expected to hold rates steady despite recent inflation data. The labor market remains resilient, with expectations of 250,000 nonfarm payroll jobs added in April. Big Tech earnings have seen mixed reactions, with Meta's stock falling over 10% and Alphabet's rising more than 10%. Apple and Amazon will report this week. Overall, S&P 500 earnings per share growth is tracking slightly above expectations at 3.5%, with increasing profit margins despite inflation and high interest rates.

Fed Rate-Cut Debate Shifts From When Toward If on Inflation Data

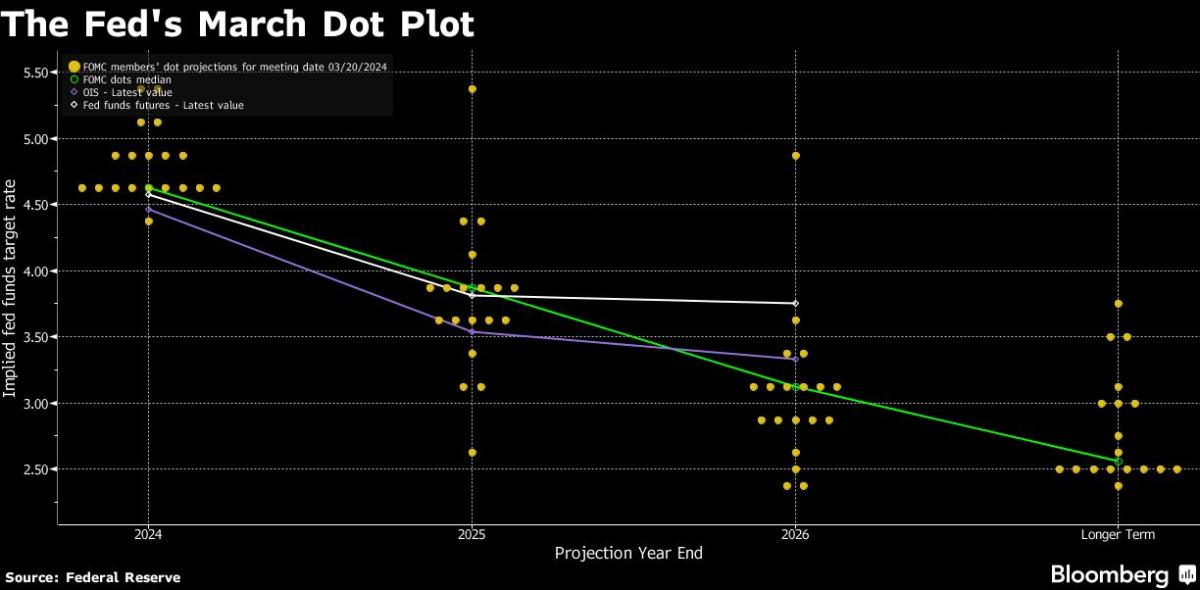

Policymakers are expected to keep interest rates steady at their meeting this week, with attention on any changes in the tone of the post-meeting statement and Powell’s press conference. They may announce a near-term slowdown in reducing the Fed’s balance sheet to avoid market disruption. After disappointing inflation reports, Powell suggested a longer timeline for reaching the Fed's 2% target, leading to speculation that rate cuts may not happen this year. Some FOMC members see no urgency for rate reductions, with only one cut predicted for 2024. Powell may emphasize the need for policy patience given the strong overall economy. Inflation progress has stalled, making it harder to justify rate cuts later in the year. It may take at least three months of better inflation data before a cut is considered, likely pushing discussions to September or later. However, cutting rates in September would attract political scrutiny ahead of the presidential election. While Powell has kept the committee united, some strains are emerging, with policymakers questioning the need for cuts since the March meeting.

Elon Musk visits China as Tesla seeks self-driving technology rollout

Elon Musk visited Beijing on an unannounced trip, meeting with Premier Li Qiang to discuss Tesla's developments in China, including Full Self-Driving (FSD) software and data transfer permissions. Tesla's FSD, already available in the US, has yet to be rolled out in China, its second-largest market. Musk indicated that FSD may soon be available to Chinese customers. He is seeking approval to transfer data overseas for training autonomous driving algorithms. Chinese regulators have mandated that Tesla store all data collected by its Chinese fleet in Shanghai. Musk's visit coincided with the Beijing auto show, where he commented on the progress of electric vehicles (EVs) in China. Tesla's VP in China argued that autonomous driving technologies would drive growth in the EV industry. Musk also announced plans for new, cheaper models and a "robotaxi" with self-driving technology. Tesla shares have declined amid concerns about its growth trajectory, with the company reporting its first quarterly revenue decline since 2020.

BHP considering improved proposal for Anglo American after bid rejected, source says

BHP Group is considering making an improved offer for Anglo American after its initial $39 billion proposal was rejected by the London-listed miner. Discussions are ongoing, and BHP has not yet decided on the size and structure of the new proposal. Anglo American rejected the initial takeover offer, saying it significantly undervalued the company and its future prospects. BHP has until May 22 to come back with a formal offer for Anglo American under UK takeover rules. It is expected to sweeten its offer of 25.08 pounds per share in an attempt to clinch a deal. Some Anglo American investors believe the company is worth around 30 pounds per share, while Anglo shares closed at 26.43 pounds on Friday. The focus of BHP's bid has been on copper, as a merger would create the world's largest copper miner, accounting for about 10% of global output of the metal. Copper is essential for various industries, including electric vehicles, power grids, and construction.