This week ahead || Sep 30th - Oct 4th 2024

Here's your news for the week ahead.

A critical labor report meets a stock market at record highs: What to know this week

Stocks edged higher last week, with the S&P 500 and Dow Jones both rising around 0.7%, while the Nasdaq gained nearly 1%, buoyed by signs of cooling inflation and solid economic growth. Investors are now focused on the upcoming September jobs report for further insights into the labor market's cooling trend. Tesla’s quarterly deliveries and Nike’s earnings are also anticipated to make headlines. With the Federal Reserve’s recent interest rate cut, investors are eyeing whether it was prompted by concerns about economic weakness or simply to sustain current growth, as labor market indicators remain in the spotlight.

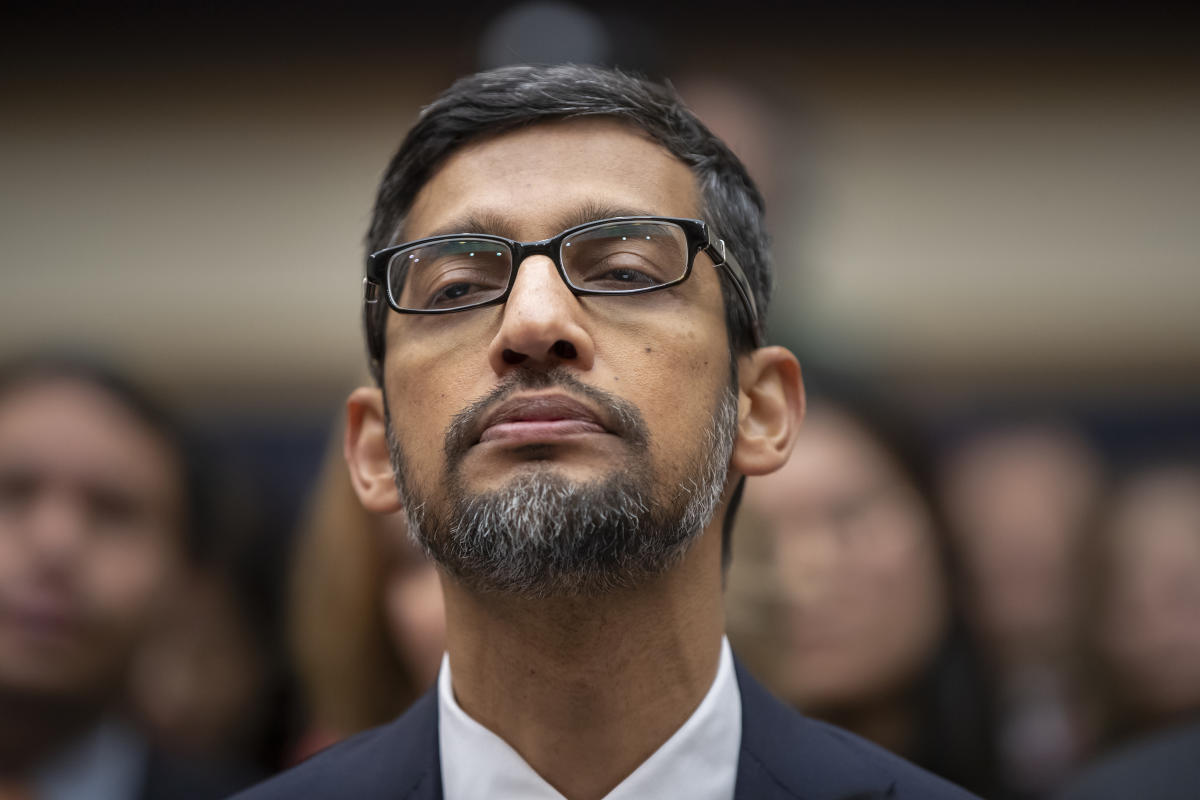

The cold war between Google and Microsoft has 'gone hot'

The long-running rivalry between Google and Microsoft has flared up again with a new antitrust complaint filed by Google against Microsoft in the European Commission. Google accuses Microsoft of using its dominant "Windows Server" licenses to unfairly tie customers to Microsoft's cloud services, specifically Azure, by making it costly to switch to competing cloud providers. Microsoft responded by predicting that Google would fail to convince the European Commission, citing previous settlements of similar complaints by European cloud providers.

This conflict revives a feud that has spanned decades, dating back to Microsoft's historic antitrust case in the 1990s when it was accused of monopolizing the web browser market by bundling Internet Explorer with Windows. That case allowed competitors like Google to gain market share. More recently, the rivalry resurfaced in an ongoing antitrust trial in the U.S., where Microsoft CEO Satya Nadella testified against Google, accusing it of monopolizing the online search market through exclusive deals. Microsoft sees this legal battle as a chance to boost its own search engine, Bing, and challenge Google’s dominance.

As the latest dispute unfolds in Europe, Google claims Microsoft is using the same bundling tactics to limit competition in the cloud computing space, marking a significant escalation in their ongoing cold war. Whether or not the European Commission will take up Google’s complaint remains to be seen, but the tension between the two tech giants shows no sign of easing.

Australia revises down commodity revenue forecasts as prices trend lower

Australia has slightly revised down its forecast for resource and energy export earnings due to lower commodity prices and a stronger Australian dollar. The government now expects export earnings to fall around 10% to A$372 billion ($256 billion) for the year ending June 2025, down from the previous A$380 billion forecast made in June. This is a significant drop from last year’s record A$415 billion. A further decline is anticipated into 2026, with revenues projected to hit A$354 billion.

The revision is attributed to slower economic growth in developed markets, high interest rates, and weakened demand from China, particularly in the property sector, which has sharply reduced demand for iron ore—Australia's largest export. Iron ore export revenue is forecast to decrease from A$138 billion last year to A$99 billion by June 2026.

Other key commodities, including metals crucial for the renewable energy transition like nickel and lithium, have also faced price declines. In particular, a surge in nickel supply from Indonesia has driven down prices, leading to the closure of some Australian nickel mines.

Freeport cranks up copper output as rivals scour for deals to grow

Freeport-McMoRan (NYSE) is accelerating its copper production across three continents without engaging in the buyout frenzy sweeping the mining industry. Analysts suggest this strategy positions Freeport well to benefit from the rising demand for copper, a key material in the clean energy transition. Copper's essential role in electrical wiring and electronics is expected to drive global demand up by at least 60% by 2050, according to the International Energy Agency.

While many competitors like BHP, Rio Tinto, and Glencore are pursuing acquisitions to boost their copper output, Freeport, the world’s largest copper producer, is focusing on expanding its existing mines. Under the leadership of new CEO Kathleen Quirk, Freeport is implementing a cost-effective leaching technique at its U.S. mines to extract copper from old waste rock, which could produce 800 million pounds of copper annually by 2027. This process is cheaper than traditional mining and eliminates the need for smelting, saving Freeport billions.

The company is also expanding other key operations, including the Grasberg mine in Indonesia, the world’s second-largest copper mine, and several U.S. and Chilean projects. Freeport's stock has risen 30% over the past year, reflecting investor confidence in its growth plans. Quirk emphasizes that Freeport is focused on creating value from its current assets rather than overpaying for acquisitions, positioning the company well for future demand.